long island tax rate

2 days agoGrand Island high school journalism program eliminated after LGBTQ topics published. California has a 6 sales tax and Los Angeles County collects an additional 025 so the minimum sales tax rate in Los Angeles County is 625 not including any city or special district taxes.

Who Determines Our Property Taxes Long Island Index

Last year the County Board lowered the tax rate by 175 cents per 100 of valuation though 075 cents of.

. A referendum will ask if voters want to raise the. That tax rate is 15 if youre married. News 529 Finder to choose the best tax-advantaged.

On July 1 1993 the Town of Long Island became the first new town in Maine since 1925. Valuation Expected Returns. Skip to main content.

Shop Costcos Long island city NY location for electronics groceries small appliances and more. These services are provided while respecting each residents dignity and personal choices. 1 day agoIn the first eight months of leasing 50 of the 670 market-rate residences in a new luxury residential tower in Long Island City have been rented.

New Inventory New Inventory. Services are provided in both public and private long-term care nursing homes and include. The 2018 United States Supreme Court decision in South Dakota v.

Package includes all taxes and gratuities inquire for additional evenings at a discounted rate. The amount needed to pay your long term care contribution is also added onto your effective rate. View the current Honda lease specials and deals available to Long Island drivers at Huntington Honda.

Has impacted many state nexus laws and. 2 Long wait lists for Affordable Housing Rentals. You can housing assistance from governmental sources for the county you wish to reside in.

The combined rate calculated by Revenue Jersey cant exceed the following. NORMAL Voters in the McLean County Unit 5 school district will decide in November on increasing the cap on the education fund tax rate. Long Island University admissions is selective with an acceptance rate of 85.

The company sports a debt-to-equity ratio of 06 and a long-term debt-to-capital ratio of 441. Long-term care provides specialized nursing and personal care services to individuals who can no longer live on their own with family or home care supports. And yet First of Long Island Corporation continues to increase its dividend reliably each year including a 53 increase in 2022.

Make sure you review your tax card and look at comparable homes. This is the total of state and county sales tax rates. In this time of higher rents many retirees may find it hard to keep up.

Some black-out dates may apply. Contributions Maximum combined tax and LTC rate. Rates include all tax and gratuities for the Spa and Hotel only.

We are always ready and waiting to go over important details regarding this process including your proximity to our Long Island location preferred delivery date and vehicle weight so call 631-573-0532 today and we will work hard on your behalf to find the best possible way to fulfill your desired vehicle delivery. Find quality brand-name products at warehouse prices. In the early 1990s when the City of Portland reassessed all of its property and the tax rate tripled on Long Island islanders decided that local control was the only way to preserve the year round community.

The total sales tax rate in any given location can be broken down into state county city and special district rates. 1 High Market-Rate Rents. But these selling events can trigger significant long-term capital gains tax liabilities.

Or use the US. The island earns its revenue through fees from tourism and work permits financial transactions and import duties Imported goods attract high duty taxes between 22 and 27 whilst luxury cars can attract a duty tax rate of up to 423 You need health care to work in the Cayman Islands and employers are required to pay half of it. For example if income is taxed on a formula of 5 from 0 up to 50000 10 from 50000 to 100000 and 15 over 100000 a taxpayer with income of 175000 would pay a total.

The effective rate is the total tax paid divided by the total amount the tax is paid on while the marginal rate is the rate paid on the next dollar of income earned. Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. The Ocean County Board of Taxation is one of the more advanced assessment systems in the State of New Jersey.

Transportation to 3 Long Island Vineyards with tastings included. In the current real estate market Long Island has 2 major housing problems for seniors. Jericho Turnpike Directions Huntington NY 11743.

We offer a variety of leasing options to fit any budget. This is calculated separately and the contribution is sent by Revenue Jersey to the long-term care fund. The Los Angeles County sales tax rate is.

About 17 million tax rebate checks from Indianas big state budget surplus that have been delayed for months will be larger whenever they start. It is now a vibrant community where citizens. This table shows the total sales tax rates for all cities and towns in Los.

The development at 29-59 Northern Blvd. LIHUE The Kauai County Council passed a bill Wednesday that introducers view as a step toward equity and balance within the Kauai property tax system. The California state sales tax rate is currently.

The company has an outstanding balance sheet.

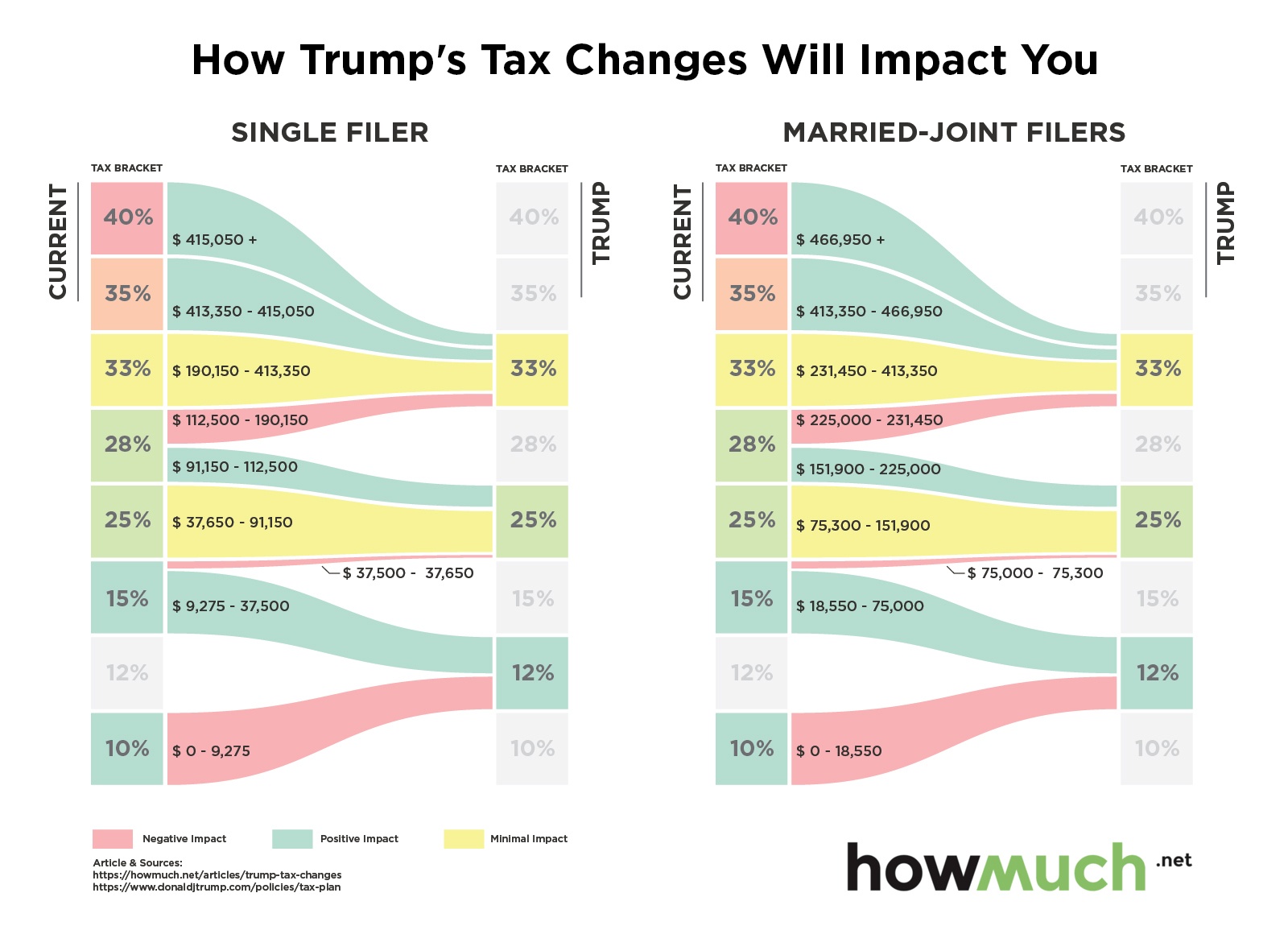

Gop Tax Overhaul How Long Island Homeowners Will Be Affected Mortgage Housing Market Homeowner

Long Overlooked Wales Offers Good Value Despite A Higher Tax Rate Mansion Global Pembrokeshire Coast Beautiful Places National Parks

Hawaii Tax Rates Rankings Hawaii State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Fairfax County Va Property Tax Calculator Smartasset

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Betterment On Twitter Investing Capital Gain Dividend

A Call For Nyc Property Tax Reform Are Staten Islanders Overtaxed Relative To Home Values Silive Com

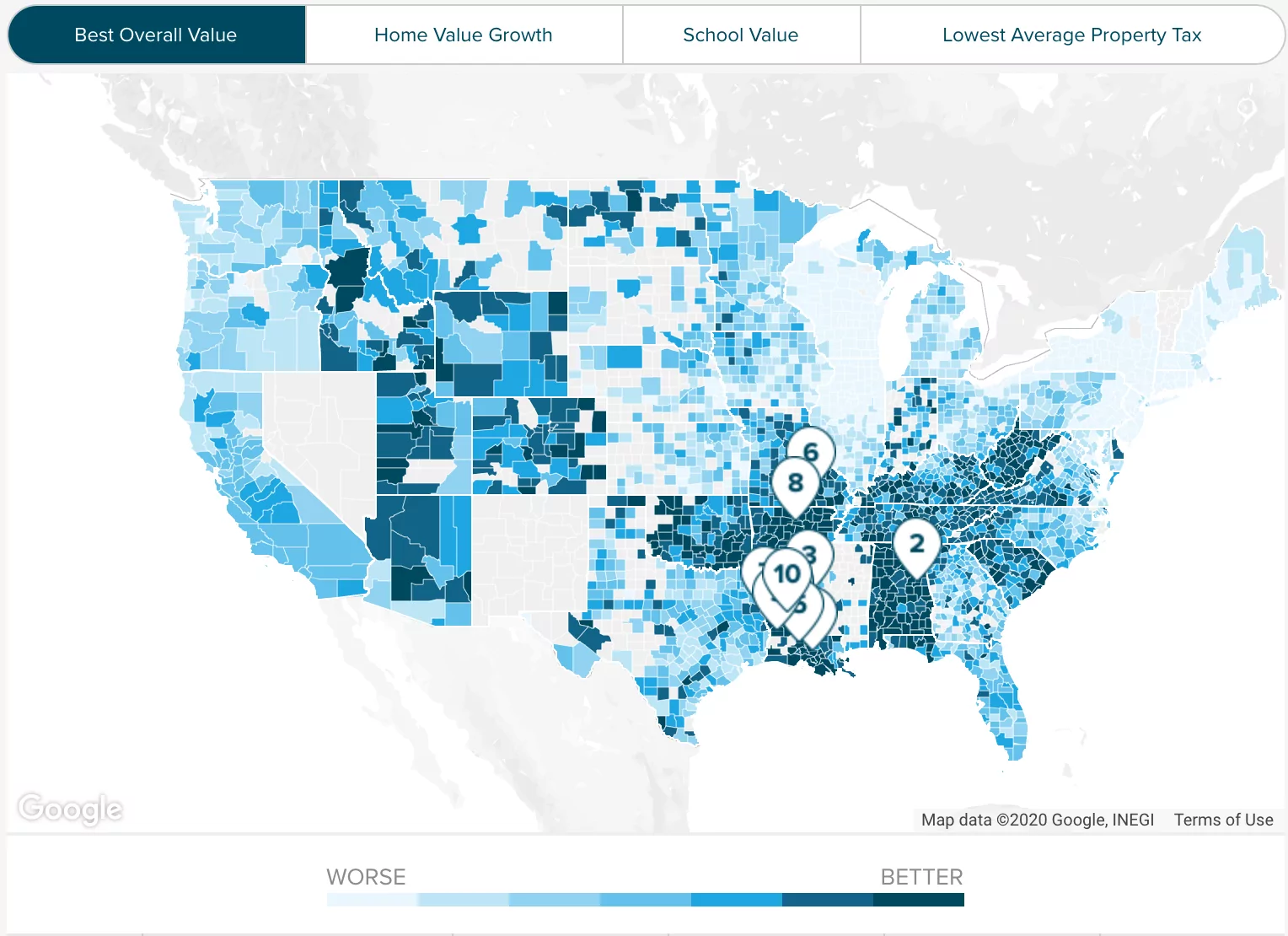

Live On Long Island 9 Things You Should Know About The New Tax Plan

Hamptons Mansion Sales Spike Ahead Of Possible Jump In Tax Rates Hampton House Hamptons Mansion Hamptons House

Hawaii Tax Rates Rankings Hawaii State Taxes Tax Foundation

Tax Adviser Chartered Institute Of Taxation Malta Editorial Special By Acumum Legal Advisory Via Slideshare Tax Advisor Tax Advisor

Investigation Mitt Romney S Offshore Accounts Tax Loopholes And Mysterious I R A Grand Cayman Island Cayman Island Grand Cayman

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy